Debunking UK government estimates on the low cost of nuclear power Prof. Peter Saunders

Few nuclear power plants have been built in Europe or America over the past twenty years. That's not because of the dangers of nuclear energy, which governments have pers istently played down, but simply a matter of economics. Nuclear has not been competitive with other sources, especially coal and gas (see [1] Nuclear Renaissance Runs Aground and other articles in the series, SiS 40).

But as we are committed to reducing our use of fossil fuels, the nuclear industry is trying to make a comeback. A recent UK White Paper tells us that it is the most cost-effective low-carbon generation technology [2].

We've been here before. When the first nuclear power plants were being built in the UK, we were promised that they were going to be a uniquely economical way of producing electricity. There were even claims that electricity meters would soon be obsolete because the price would be so low it wouldn't be worth measuring how much we used. In fact, nuclear power has turned out to be very expensive, which is why the Thatcher government was not able to sell the nuclear power stations when it privatised the rest of the electricity supply industry. The taxpayer was left to pick up the tab for the cost of decommissioning and disposing of the waste, and the bill is £72bn and rising (see [3] Nuclear Industry's Financial and Safety Nightmare , SiS 40).

This time, the g overnment assures us, things are going to be different. Nuclear energy will not be too cheap to meter, but it will produce clean electricity at a competitive price. That will make it an attractive investment for private industry, which will bear the costs of building, operating and decommissioning the plants. The government will only have to give a clear go-ahead so the process can begin, streamline the planning process to avoid ‘unnecessary' delays, and set up some scheme whereby a small fraction of the money paid by the consumers will be put aside to cover the costs of decommissioning and waste disposal. The government will neither have to contribute any taxpayers' money nor get involved in organising new ways of producing and distributing electricity. It will be a simple matter of disconnecting the old coal and gas powered stations and plugging in the new nuclear plants [2].

However, a recent report from Citigroup Inc, the world's largest financial services network, paints an entirely different picture [4]. They point out that the UK is the only country where new nuclear is currently being proposed without financial underpinning from the state. They see little prospect of any new nuclear stations being built in the UK unless the government provides substantial subsidies in one form or another.

The claim that nuclear energy will be self-financing depends on assumptions that are out of line with other current estimates. If the government commits us to a heavy dependence on nuclear power and only afterwards realises that subsidies are required to get the plants built and running, we will have written the industry a blank cheque.

There is no need to go for nuclear energy at all, because renewable sources such as wind, solar, biogas, tidal and so on are capable of supplying enough energy (see [5] Green Energies 100% Renewables by 2050 , I-SIS publication). Furthermore, while the cost of nuclear energy keeps rising, that of renewable energies is falling as the technology improves. Since 1990, for example, the cost of solar photovoltaic power in the US has fallen by about half in real terms (i.e. after correcting for inflation) and while it was then about four times as expensive as grid electricity it is expected to reach parity in 2015 [6].

That is why Germany has chosen not to build new nuclear plants but to meet its carbon targets by switching to renewable sources [7] ( Germany 100 Percent Renewables by 2050 , SiS 44) . It also means to keep its industry strong by becoming a world leader in renewable technology.

The UK could and should do the same. Instead, it seems determined to repeat its earlier mistakes on an even grander scale, investing heavily in a technology that is hazardous, uneconomical and ultimately unsustainable (see [8] The Nuclear Black Hole , SiS 40).

Nuclear power stations are very expensive to build, and so the cost of construction is very important in determining the price of the electricity they produce. And on this crucial point there is a very large discrepancy between the White Paper and other estimates.

There are two ways of quoting the price of building something big and complex. The first, the “overnight cost”, is what it would cost if the construction could be completed literally overnight. All the materials, labour and other charges are calculated at today's prices, and nothing is allowed for the cost of finance while the plant is under construction. The other, the “cost of construction”, includes those considerations and is supposed to represent what the project will actually cost.

If you have ever got estimates from more than one builder for work to be done on your house, you won't be surprised that estimates of the overnight cost of constructing a nuclear power station can vary considerably. There is, however, even more variation in estimates of the cost of construction.

Because a great deal of money has to be spent years before a single dollar is earned, there will be a large accumulation of interest to be paid back before there is any revenue. Different estimates of the cost of finance will therefore lead to substantially different estimates of the cost of construction. Second, while construction is in progress, the costs of materials, labour and so on will increase. This would not be so serious if they rose with the retail price index (RPI) but experience shows that they rise much faster. In the US, for example, the RPI rose by about 20 per cent between 2000 and 2007. Yet according to Cambridge Energy Research Associates, an organisation that advises industry, governments and financial institutions, over the same period the Power Costs Capital Index (PCCI) rose by 130 per cent, i.e. about 12.5 percent a year [9]. Estimates that do not allow for that are likely to be far too low.

The total cost depends very much on how long it takes to build the plant. A delay of a year or two can make a very big difference as interest payments mount and other costs escalate. Nuclear power stations are notorious for coming in late and over budget. The plants built in the USA in the 1960s and 1970 s typically cost between two and four times the estimates presented at the start of construction, which is largely why utilities stopped ordering them 10]. As for the new generation of reactors, Schneider reported in 2009 that of the 45 nuclear power plants then under construction, no fewer than 22 had encountered construction delays [11]. One of the two currently being built in Western Europe, Olkiluoto in Finland, is three years behind schedule and expected to cost at least 50 per cent more than the contract price. The other, at Flammanville in France, is also late and over budget.

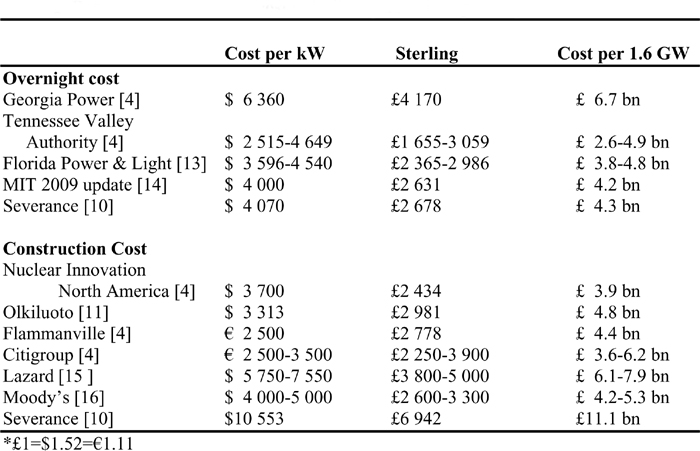

The White Paper estimates the overnight cost of a nuclear power plant to be

£1 250/kW, and the construction cost £1 750/kW, making the total cost of a 1.6GW plant £2.8bn. This is based on the results of an OECD Nuclear Energy Association study published in 2005 [12]. But costs have risen sharply since then and almost all recent estimates are substantially higher (see Table 1).

Table 1 Recent estimates of the cost of building a nuclear power plant*

Despite the considerable variation among these estimates, there is a clear consensus that the cost of building a nuclear power plant will be at least half again as much as the figure the UK government has used to justify its claim that nuclear power is economically feasible.

The original estimate of the cost of the Olkiluoto plant, agreed in 2003, was €3 bn, almost exactly the figure the 2008 White Paper assumes for a similar reactor. Areva said in 2009 that they expected a new reactor begun then would cost as much as €6bn (£5.4bn) [11]. In the White Paper, however, we are told [17]: “ The total build cost in each scenario is higher than the fixed price contract estimates for the nuclear power station is [sic] currently under construction at Olkiluoto in Finland – the cost of which is currently projected to be £2.7 bn.” Read quickly, this might be taken to mean that the 2008 White Paper estimates are higher than the current projected cost of building the Olkiluoto station. What it actually says is that they are higher than the estimates that were made in 2003 and which are about half what the builders would now predict. This might be the result of careless drafting, but that is surely unlikely in a White Paper.

The estimates from Citigroup, Lazard and Moody's (see Table 1) are especially significant because the private sector solution depends on whether investors find nuclear power an attractive prospect, whatever the White Paper says.

In the end, what matters is the price the consumer has to pay for low carbon electricity, however the costs are incurred. Estimates (per MWh) range from $29 [12] (US Energy cost figures [12]) to $108 [18] and $300 [10]. The Nuclear White paper estimates between £31 and £42. The Citigroup report estimates a price of at least €65/MWh (€70 if there is a two year delay in construction and achieving peak load) if investors are to make an acceptable return. In its paper The Economics of Nuclear Power , released in January 2010, the World Nuclear Association states that figures from Finland in 2003 put the nuclear cost at €32.3/ MWh [12]. Like the White Paper, however, the WNA report does not update the 2003 Olkiluoto figures, so its estimate is bound to be too low.

Much of the wide variation in estimated prices is due to the different ways in which they are calculated. The lowest figures generally do not include the capital costs of the plant [19] - the largest component of the total cost and difficult to predict – which makes them convenient for lobbying but of little use in a serious discussion of the economics of nuclear power.

Low figures can also conceal large subsidies. If, for example, the £72 bn or more that British taxpayers are going to pay for decommissioning the last generation of nuclear power plants and disposing of the waste were added to our electricity bills instead, the true cost of nuclear power would be more obvious. Some have carbon credits or similar subsidies built in, others do not, and this too can make comparisons misleading. Estimates based on past experience might appear more reliable, but even if all the hidden costs have been included, which is very hard to tell, they seldom make adequate allowance for the very great increase in construction costs since those plants were built.

A major issue is the cost of capital. Most studies assume a discount rate of 5 or 10 per cent (see Box), which we choose makes a considerable difference. Even more importantly, if power stations are to be built by the private sector, part of the investment will be as equity rather than debt. If the investors demand a higher rate of return than the interest payable on a loan, either because of the risk they are taking or because of tax considerations, or both, then the effective discount rate will be higher and the price of the electricity will rise accordingly.

Discount rate explained

Suppose we are considering spending £1000 to build something that will earn us a certain amount of money in 10 years time. To decide whether this is a good investment we have to compare the outcome with what we would get if we simply deposited the money in the bank and let it accumulate interest. If, for example, we could get 5 per cent interest a year, after 10 years we would have 1000 × (1.05) 10 =£1629. So an investment that promises less than £1 629 in ten years time is not worthwhile. The usual way of expressing this is to say that at a 5 per cent discount rate, £1629 in ten years time has a “present value” of £1629/(1.05) 10 = £1000. Obviously the greater the discount rate, the greater the payment ten years hence must be to have a present value at least as great as the investment. If, for example, we assume a discount rate of 10 per cent, we would need to earn £2594. At 14.5 per cent (the effective rate assumed by Severance [10]) we would need to earn £3873. Because so much of the cost of nuclear energy is paid up front, any estimate of the price that will have to be charged for the electricity will depend very much on the discount rate assumed.

This largely explains why even though Severance's estimate [10] of the overnight cost of construction is in line with other estimates, the total cost of construction and the price of electricity are much higher. He supposes that roughly half the investment will be in equity and that the investors will demand a return of 15 per cent net of corporation tax. Different assumptions will naturally produce different figures, but the role of equity must be taken into account when considering the private sector option. UK experience with the Private Finance Initiative (PFI) shows that involving the private sector can greatly increase costs while leaving the risk to be borne by the taxpayer.

Severance's analysis has been criticised [20] and he has defended it robustly [21]. For example, the critic points out that over the past year and a half construction costs have risen by far less than the rate of 12.5 per cent S everance uses in his calculations. Severance responds that costs are bound to rise more slowly in the period following an economic failure like the collapse of the banks.

The UK government apparently believes that nuclear energy will provide low-carbon electricity safely and at no cost to the taxpayer and a competitive price to the consumer. I wouldn't put money on that, and neither, it seems, will the major financial institutions.

Unless it changes its mind soon, the government will commit us to nuclear power and only later accept that it will have to provide the subsidies it promised were not going to be needed. It may do this directly by large handouts to the companies, but it could also try to conceal it by various devices. It could provide finance for construction at favourable rates or offer loan guarantees, it could agree to buy large amounts of electricity at above-market prices, it could take a very optimistic view of the costs of decommissioning and waste disposal. The nuclear industry will have become too important (if not too big) to fail and, one way or another, the taxpayer will be called upon to make sure that it doesn't. Having chosen nuclear because we were told it was cheaper than other sources, we will find ourselves paying more.

We do not need to build a new generation of nuclear power plants. We can satisfy our energy needs by a combination of renewable sources [5] as Germany is already planning to do. It's worth bearing in mind that nuclear currently produces only about 13 per cent of the UK's electricity, and that this will fall to 8 per cent by 2020 as old plants reach the end of their useful lives. By then, even the government expects that renewables will be supplying 30 per cent.

We must greatly improve energy efficiency and reduce high carbon activities in such areas as transport, which is currently responsible for a fifth of our greenhouse gas emissions. Farming, changes in land use and waste together account for 11 per cent, and we need to make changes here as well (see [22] Food Futures Now: *Organic *Sustainable *Fossil Fuel Free, I-SIS Publication).

Nuclear energy is clearly not necessary. Moreover, if the UK rushes ahead with nuclear we are likely to find other countries doing better by concentrating on renewables and we will end up having to buy electricity generating equipment from them. Already both China and Germany are setting out to be world leaders in the field. And despite what our government and the industry would have us believe, nuclear energy is also hazardous (see [23] Close-up on Nuclear Safety , SiS 40).

Article first published 12/05/10

Comments are now closed for this article